In Forex trading, exchange rate quotes can be provided in two different ways. They include direct and indirect quotations.

A direct quote is a more common way when 1 unit of foreign currency is expressed in 1 unit of the domestic currency. Oppositely, indirect quotes show 1 unit of domestic currency expressed in a foreign currency.

In this article, we will explain how direct and indirect quotations work in Forex trading as well as how to calculate them using a simple formula.

As stated earlier, a currency conversion rate can be expressed in two different ways. When using indirect quotes, we consider a fixed foreign currency exchange rate while a domestic currency can vary depending on the country and location where the exchange takes place.

Direct quotation is simpler for consumers and beginner traders to understand. It shows how much domestic currency is needed to convert it into pegged foreign currency. If the conversion rate is low, the value of a local currency is going up in reference to a foreign asset. If the exchange rate is high, a local currency loses its value in the Forex market.

Industry-best trading conditions Deposit bonus

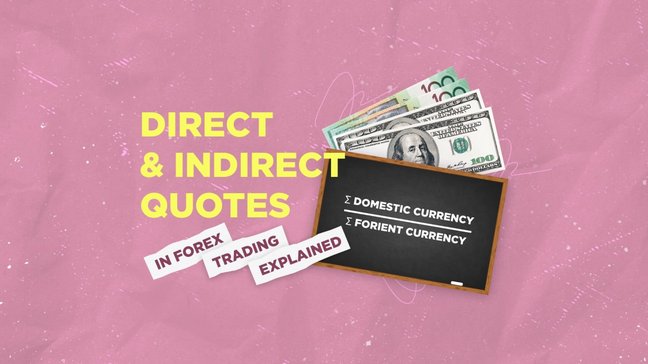

To calculate direct quotes, one should divide the amount of domestic currency into the amount of foreign currency. In the end, you will have the amount of local currency needed to buy 1 unit of foreign currency.

Direct quotations are the most popular and simple way to express foreign currency exchange rates. However, it is commonly used when the base asset comes with a higher value compared to the counter asset.

For example, at some point, you will need 72 rupees (INR) to purchase 1 USD. In this case, we have an example of direct quotation, as the U.S. dollar comes as a fixed currency, while INR is a variable one. So, we have USD as the base asset, as it comes with a higher value compared to the counter currency (INR).

The two concepts basically serve the same purpose. However, from the conceptual point of view, they have the following differences:

Most traders use the direct quotation method. It is a simpler way to determine the currency value. What’s more, it offers some extra benefits you might appreciate:

Considering all the above-mentioned, most traders use direct quotations as they are simpler to read and understand, especially when it comes to beginners in Forex trading. The approach lets them easily read different currency exchange rates as well as the overall economic situation across different nations. At some point, you may need historical data to compare it with the current exchange rate to see the complete picture.

As we know, the Forex market is unregulated and decentralized. So, who actually sets the exchange rate? Where do brokers and traders get quotes? It depends on the supply and demand, the geopolitical situation, news, and many other factors that affect the currency price. What’s more, exchange rates tend to fluctuate all the time.

At the same time, rates also depend on the rate at which traders are willing to buy one currency against another. Following the same logic, the selling rate depends on the traders’ willingness to sell available currency at a specific rate.

Exchange rates are changing all the time. They never remain the same. The value of at least one currency in a pair will be different from time to time. This is what we call “fluctuation”. So, an asset that once used to be of high value can be depreciated in the spur of the moment depending on such crucial factors as supply and demand.

This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks.

if you have any questions, please contact us via support@mtrading.com or use live chat

Visit us at No 5, Jalan Anggerik Vanda 31/166C, 40460, Kota Kemuning, Selenagor

ServiceComsvg LLC registered at PO Box 2897, Euro House, Richmond Hill Road, Kingstown, Saint Vincent And The Grenadines, VC0100 with registration number: 1593 LLC 2021.

© 2013 - 2024 MTrading

Risk warning: Trading foreign exchange or contracts for differences on margin carries a high level of risk, and may not be suitable for all investors. There is a possibility that you may sustain a loss equal to or greater than your entire investment. Therefore, you should not invest or risk money that you cannot afford to lose. You should ensure you understand all of the risks. Before using ServiceComsvg LLC services please acknowledge the risks associated with trading. The content of this Website must not be construed as personal advice.

MTrading does not provide services to residents of certain jurisdictions, such as: Japan, the United States of America, Canada, Germany, New Zealand, and some other regions. For more information please refer to our FAQ section